Keep updated with Whyfield news

and the latest industry insights...

-

Bank savings protection limit increased to £120k

From December 2025, the FSCS will increase its cover from £85,000 to £120,000. Here’s what the change means and how it could affect the way you manage your money.

-

The real impact of targeting salary sacrifice

Crossing the £100,000 income threshold can trigger unexpected tax charges, reduced childcare support and a significant drop in take-home pay. Laura Whyte explains how salary sacrifice can help households navigate these pressures and why the issue matters to businesses and employees alike.

-

Help setting up and running a small business

Starting your own business is so exciting, but we know it can also feel a overwhelming. From choosing the right business structure to understanding your tax responsibilities, there’s a lot to think about before you officially open your doors (or launch your beautifully curated website and socials!).

-

How to check if a letter, call, or email from HMRC is genuine

Making sure your money and details are safe is so important. We know it can be scary knowing that the scams from fraudsters look more and more genuine each time. So, to make things easier and take some of the worry away, we’ve broken down how to check if your correspondence from HMRC is genuine.

-

Self Assessment customers targeted

As we move into Self Assessment season, HMRC is reminding everyone to stay alert to scam emails, texts, and calls claiming to be from them.

-

Directors Must Verify Their ID from 2025: A Guide to the New Companies House Rules

From 18th November 2025, you will need to verify your identity with Companies House before you can set up, own or manage a Limited Company in the UK.

-

How HMRC’s new crypto reporting rules could affect you

From 1st January 2026, HMRC will start receiving detailed information about UK crypto holders from platforms and service providers. And, if you don’t tell them about your activity, you could face a fine of up to £300.

-

Giving business gifts? Don’t forget the rules

From Christmas hampers to client thank yous, HMRC sets strict rules, including the £50 limit. Learn when you can reclaim VAT, the cashflow benefits, and how to claim back past VAT on gifts.

-

Debunking TikTok tax myths

There are now more than 12,000 TikTok videos out there giving tax and accounting “advice”, and it’s important to know that not all of it is helpful or even true.

-

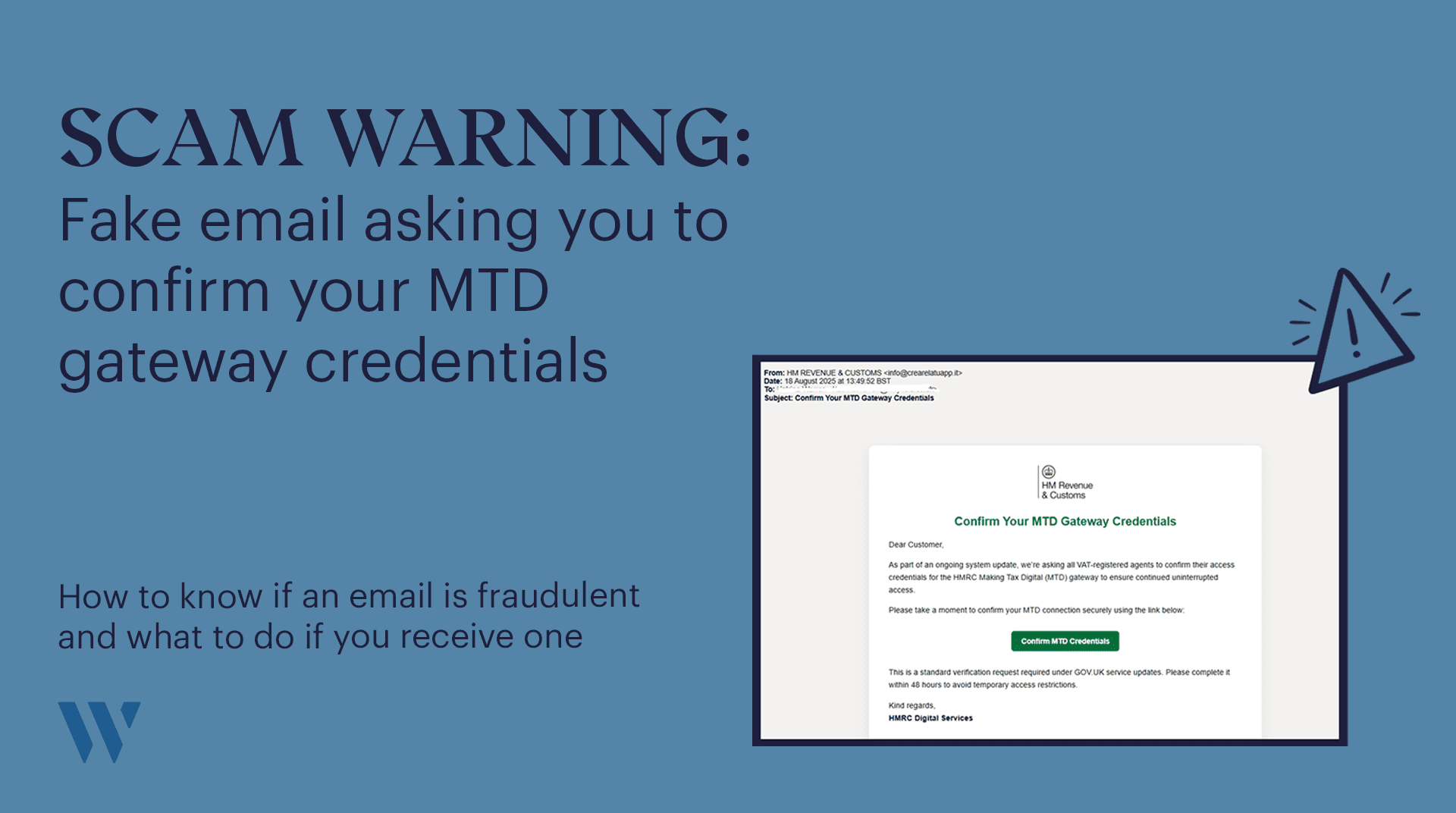

Fake email from HMRC asking you to confirm MTD gateway credentials

We have recently been sent an email from an account pretending to be HMRC, asking to confirm MTD gateway credentials that need to be actioned within 48 hours.

-

35 million UK workers will now be able to access their taxes more easily than ever before

As part of a big push to encourage more people to use their digital tax accounts, HMRC are planning to roll out a wider range of services you can access through your online account or the HMRC app.

-

Thinking of cancelling VAT registration? What small business owners need to know

The economic environment is currently throwing more uncertainty at business owners, and we are seeing more enquiries regarding VAT deregistration, especially those providing services to the public.