Tax

-

What your UK tax code means: could you be owed a refund from HMRC?

You could be on the wrong tax code and overpaying HMRC. Find out how to check it, what it means, and how to claim back what you might be owed.

-

Managing higher Capital Gains Tax on Business Asset Disposal

From April 2025, the Capital Gains Tax (CGT) rate for Business Asset Disposal Relief (BADR) is increasing, meaning business owners could face higher tax bills when selling their companies.

With rates rising to 14% in 2025 and 18% in 2026, planning ahead is important. Learn how these changes impact you and what steps you can take to minimise your tax liability before the hike kicks in. -

You can now claim tax relief on your personal and workplace pension payments online

If you pay into a pension scheme and qualify for additional tax relief, you can now apply online through HMRC without filing a full tax return. Find out what you’ll need and how to get started.

-

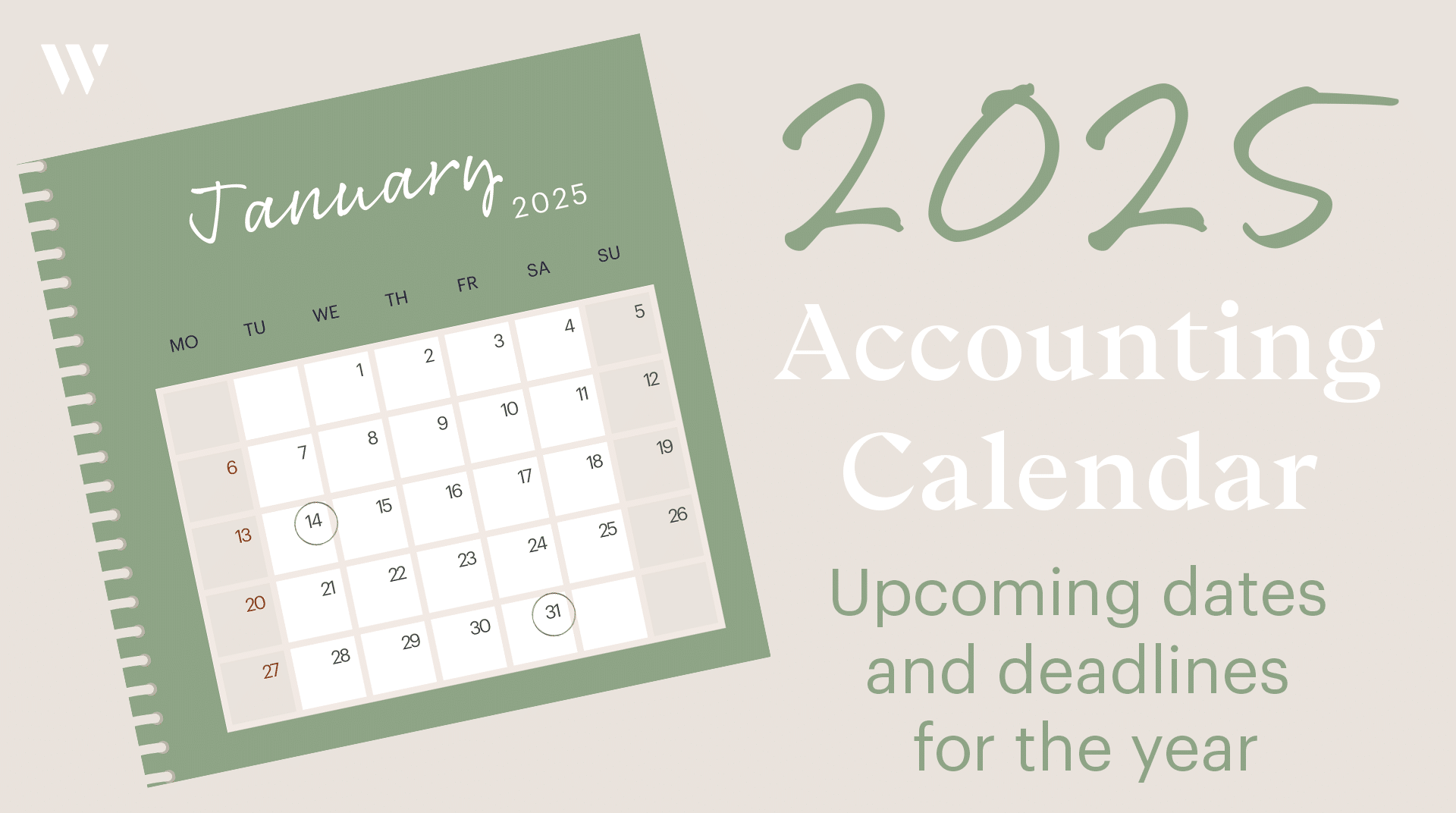

Important dates and deadlines for the accounting calendar

To make sure you’re ‘in the know’ about upcoming dates and deadlines in the UK accounting tax calendar.

-

Double-cab pickups to be classified as cars

Within The Government’s Autumn Budget were changes to the tax treatment for Double-Cab Pickups (DCPUs) with a payload of over one tonne (1,000 kilos).

-

Changes to Tax Relief Claims

Changes to tax relief claims for employment-related expenses along with the evidence that now needs to be supplied to support their claim.

-

Selling Property? Get to know the 60-Day Capital Gains Tax Rule

Anyone selling residential property must report and pay any Capital Gains Tax within 60 days, with strict penalties for late filing—read on to find out how to stay compliant.

-

Upcoming Furnished Holiday Let (FHL) tax changes

Key updates that property owners of FHLs need to know, ahead of 6th April 2025, affecting areas such as tax relief on loan interest, pension contributions, capital allowances, and more.

-

Spring Budget 2024

Read our breakdown of the Chancellor’s Spring Budget for 2024. This is what we know so far…

-

Employees will now be paying less tax!

The Chancellor’s recent National Insurance cut is now in place. But how will it impact your pay packet? While the 2p reduction brings immediate savings, we hear from experts to highlight considerations regarding frozen tax thresholds.

-

Trading Allowance for selling second hand and handmade

It’s the beginning of the new year, and you’ve decided to finally declutter your wardrobe by selling some pre-loved pieces on platforms like Depop, Vinted and eBay. Do you need to pay tax on that?

-

The Advantages of Working with a Xero Certified Accountant

By undertaking cloud accounting software training, you can ensure you are maximising your return on the investment of a digital system.