-

Financial support for hospitality and leisure

Chancellor Rishi Sunak has announced extra support for the hospitality and leisure sectors in England in the run-up to Christmas.

-

The Self Employment Support Scheme Details so Far

The Self-employment Income Support Scheme (SEISS) will support self-employed individuals whose income has been negatively impacted by COVID-19.

-

The Job Retention Scheme: What Employers can Claim

Details on the Job Retention Scheme are coming. Find out how employers will be able to claim up to 80% of their employee’s wages.

-

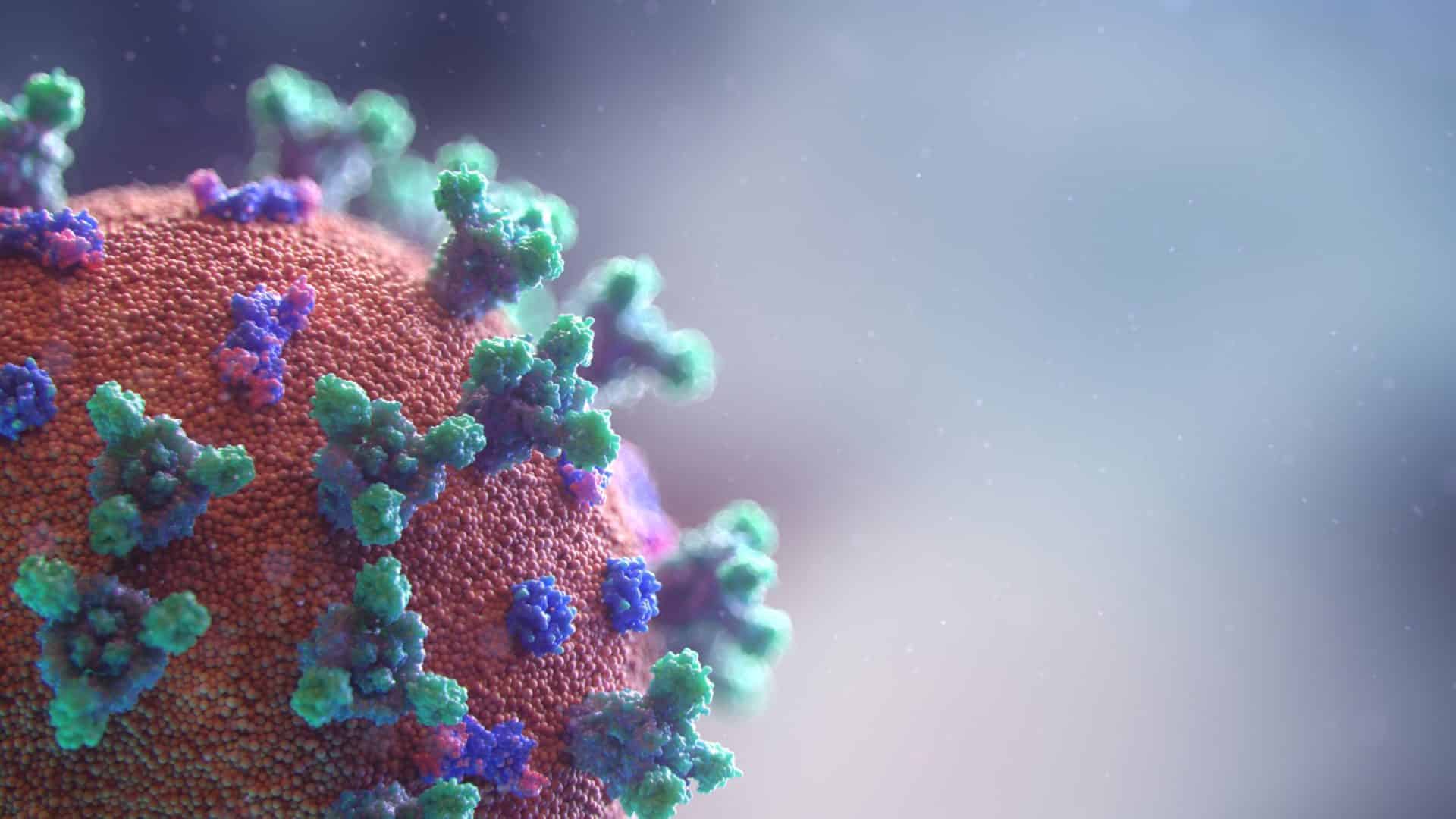

Business support for those affected by Coronavirus

We have all the info that HMRC have launched for those concerned with how they will meet their HMRC liabilities during the pandemic.

-

Budget: The Key Points for Businesses and Employees

Read up on the March budget announcement covering coronavirus response, business taxation, personal taxation, alcohol, tobacco and fuel.

-

A Head-on Approach to Mental Health in the Workplace

We are dedicated to changing the attitude towards Mental Health in the workplace. Read about our 2020 plans.

-

Apprentice Job Vacancy

Employer Description Whyfield is a well-established accounting and bookkeeping firm based in Threemilestone, which is just outside of Truro. They offer support to businesses of all sizes including sole-traders, partnerships and limited companies. The turnover of these businesses can range from several hundreds of pounds to several millions of pounds. Specialisms within the team include

-

HMRC Delays Making Tax Digital

HMRC has announced a number of changes to the Making Tax Digital scheme. They have revised the timescale following feedback from businesses, accountants and Parliament. This is good news because it means that businesses will now have more time to implement the changes required. Similarly, many smaller businesses or self-employed individuals will not have to

-

Making Tax Digital

What does HMRC’s Making Tax Digital Scheme mean for you? Making Tax Digital forms the main part of HMRC’s big plans to reform the UK tax system. The Making Tax Digital scheme was announced in March 2015 and since then, there have been various consultations and government debates on the topic. This is the largest

-

Did you see the Whyfield team at the Cornwall Business Show?

The Whyfield team attended the Cornwall Business Show at the Royal Cornwall Showground on Thursday 16th March. This was our third year of attendance and the Whyfield stand was as popular as ever. Almost everyone in the team popped along at some point. Large jars of Cadbury Creme Eggs were available for visitors, in addition

-

Whyfield Celebrates Three Years of Success!

Whyfield is celebrating its third year of trading this week. The whole Whyfield team would like to say a big thank you to each and every client that we have worked with. We would also like to say a big thank you to everyone that has helped us along the way, including friends, family, other

-

Good or bad news: what does the latest budget mean for you?

Good or bad news: what does the latest budget mean for you? Is it good or bad news? We’ve all had a couple of weeks to digest our thoughts on the latest budget. This post rounds up some of the key changes proposed by Philip Hammond and his Government colleagues. Here at Whyfield, we feel