Working in the hair and beauty industry: are you employed or self-employed?

Whether you work in the hair and beauty industry, or run a salon, figuring out whether someone is employed or self-employed can have different tax implications, so it is really important to get it right. Understanding this will tell you who must pay Income Tax, National Insurance Contributions, or even VAT.

HMRC has a tool that can be used to determine your employment status, or if you are a salon owner, determine the status of the people who work within your salon. We have included a link to this tool below for you:

Check employment status for tax – GOV.UK

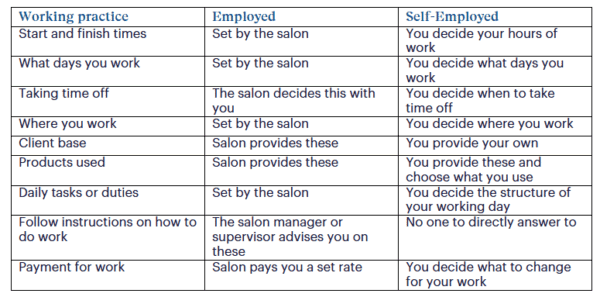

A good place to start is to consider what your day-to-day activities look like and who decides them. The below table outlines key indicators that you may be considered employed or self-employed

So, what does it mean if you are employed?

It will mean that you have all the rights of an employee. This includes things such as statutory sick pay, annual leave, and other statutory benefits. They will also deduct Income Tax and National Insurance contributions from your pay.

What about if you are self-employed?

You would not have the same employment rights as an employed worker would. It’s important to remember though, even if you’re self-employed for tax purposes, you may have worker status for employment law purposes.

Anyone in this position would need to register for self-assessment with HMRC and ensure that their income and expenditure is declared to HMRC annually via a Tax Return. You will pay your Income Tax and National Insurance contributions via your self-assessment.

Should you have trading income over the VAT threshold, currently £90,000, you will need to register for VAT and complete quarterly VAT returns to HMRC to pay any VAT liability due.

I’m a salon owner, what does this mean for me?

It’s important to regularly evaluate the ‘employment status’ of the people that work in your salon to ensure you are paying them correctly and staying compliant with employment law.

If your turnover for the salon is over the VAT threshold, of £90,000 in a 12-month period, you will need to register with HMRC to report your income and settle any VAT liabilities due each period.

If you’d like help determining your employment status, or that of your salon workers, please get in touch with the team – we’re more than happy to help!

You can call us on 01872 267 267, email us contact@whyfield.co.uk, or message us on WhatsApp 0777 49 39 111.

For regular updates and information, make sure you’re following our socials:

Instagram | LinkedIn | Facebook