-

Opportunity for Young Business people in an exciting FMCG business in Cornwall!

Read about the unique opportunity for young businesspeople with the creators of Land of Saints Gin.

-

Christmas: The Tax Implications of Gifting

Everyone likes to be able to give gifts, especially around Christmas time but what are the tax implications of doing this through your business?

-

Health & Wellbeing at Whyfield

We are proud of our proactive approach to supporting health & wellbeing in our workplace. Read about the initiatives we have put into place at Whyfield.

-

Whyfield Practice Manager Promotion

We are delighted to announce that Jessica Crook has been appointed as the new Practice Manager at Whyfield. Read about her progress into the role.

-

Reverse Charge VAT for Construction Services

Reverse Charge VAT for Construction Services postponed by 12 months, meaning the change will not be implemented until 1st October 2020.

-

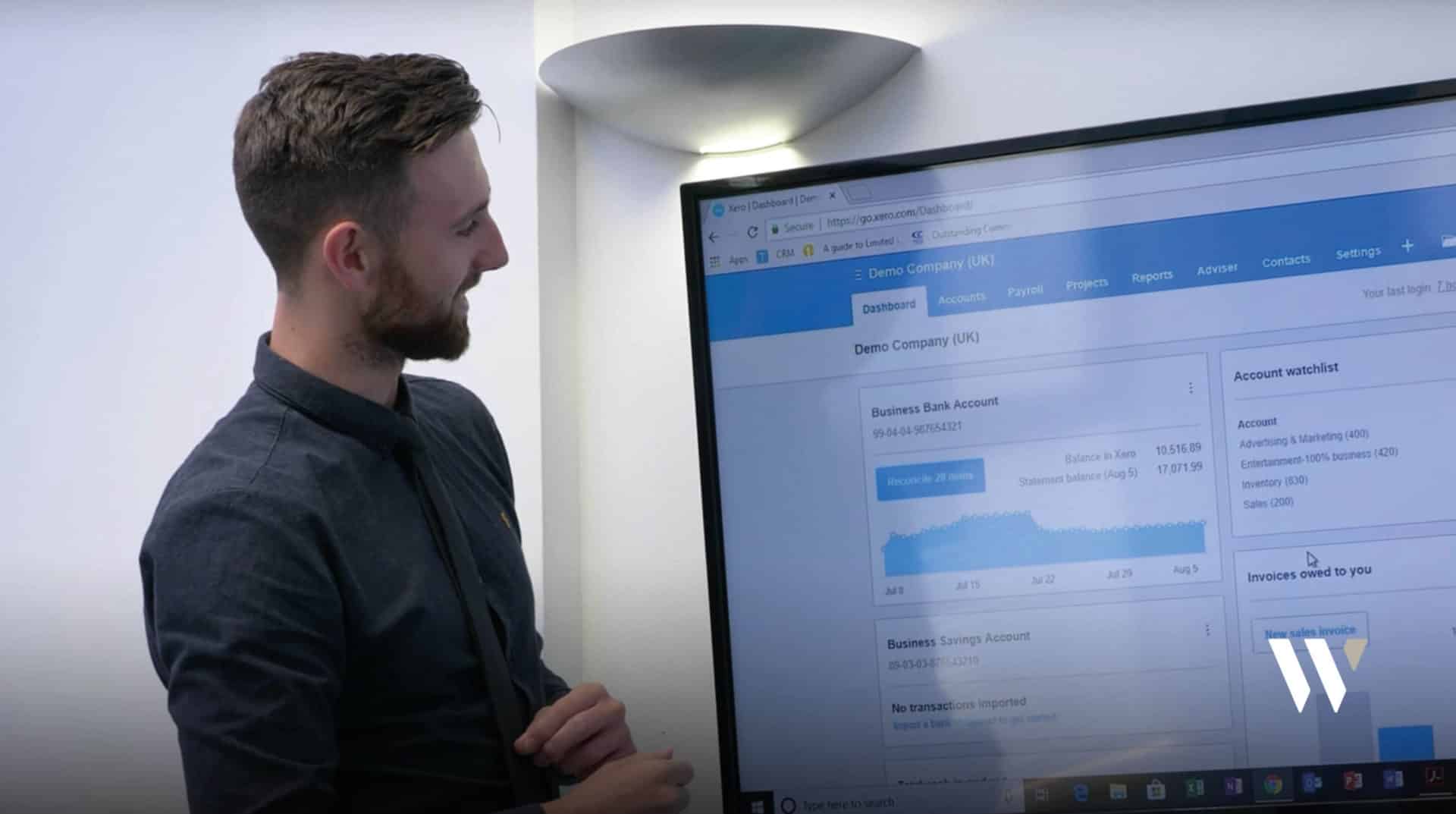

Cloud Software Training Sessions with Whyfield

We were delighted to provide cloud software training at the Cornwall Chamber of Commerce’s Cornwall Festival of Business this year.

-

Construction Industry Reverse Charge

The change will shift the responsibility for accounting for the VAT on ‘specified services’ from the supplier on to the recipient of the supply.

-

Tax Year personal tax rate changes and allowances 2019/20

Personal Tax These come into force from the 2019/20 tax year including, an increase to the personal allowance and higher rate threshold, changes to residential inheritance tax and capital gains tax regime for non-UK residents Personal allowance and higher rate threshold The personal allowance increases on 6 April 2019 to £12,500 from £11,850. This will

-

High Income Child Benefit Charge (HICBC)

Introduced by HMRC in 2013, the High Income Child Benefit Charge applies to parents earning over £50,000 adjusted income per year. Total taxable income less pension contributions and gift-aid donations give the adjusted net income figure. HICBC places a tax charge of 1% on child benefit for each £100 above the £50,000 threshold the high-earner

-

Self-Assessment Tax Return Penalties

Based on recent years HMRC will potentially issue at least 1 million late filing penalties. It is important to be ahead of the game in terms of advising clients who have failed to meet the filing obligation and to be able to address disputes with HMRC. Finance Act 2009, Schedule 55 and Schedule 56 reformed