Training & Support

-

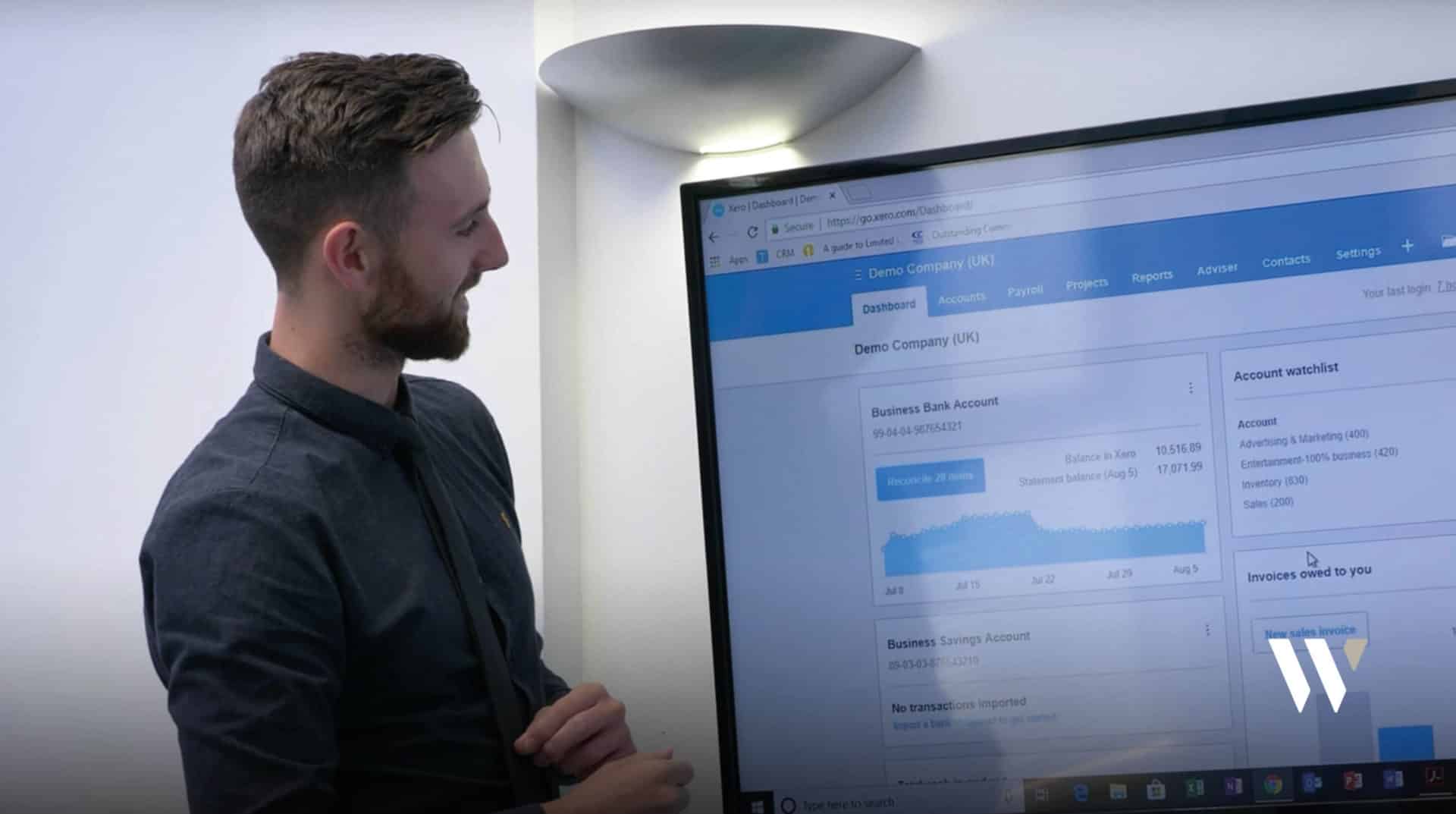

Maximise Your Business’s Productivity with Whyfield’s Cloud Accounting Software Training

By undertaking cloud accounting software training, you can ensure you are maximising your return on the investment of a digital system.

-

Xero Integrates with Shopify

Xero’s game-changing integration with Shopify brings many benefits for online retail businesses. Find out more about the update

-

Take the Stress out of Health and Safety

Cornwall Training & Consultancy share their biggest tips on getting the right health and safety training for your business.

-

Quickbooks Expert Setup Onboarding

We have two Quickbooks onboarding sessions coming up which will be co-hosted by Quickbooks. Book your session now to secure a place!

-

Cloud Software Training Sessions with Whyfield

We were delighted to provide cloud software training at the Cornwall Chamber of Commerce’s Cornwall Festival of Business this year.

-

Whyfield launches cloud accounting software training

We’re excited to announce dedicated training packages to help local business owners and finance professionals get the most out of cloud accounting software. The new courses are designed for all businesses so you don’t need to be a Whyfield client to sign up but of course you’ll get a discount if you are. Either way

-

Are you ready to make tax digital? Most Cornish businesses aren’t.

Making Tax Digital is the latest move by the Government to make it easier for individuals and business to get their tax right and stay of top of their affairs. But there’s one small problem with this plan … according to our research, it seems that businesses in Cornwall just aren’t ready for it at

-

Reaping the rewards of mentoring

Earlier this year we announced that we won another tender to supply mentoring support for the Unlocking Potential programme in Cornwall. To date, we’ve given over 200 hours support to business ideas and startups. Our support has included cash flow forecasting, bookkeeping, balance sheets, profit and loss, management accounts, financial ratios, survival budgeting and of

-

Is your Sage software compliant for Making Tax Digital?

Sage, the old favourite, something that is synonymous with the accountancy profession, is changing to get ready for Making Tax Digital (MTD). Whilst that shouldn’t be surprising, given they are one of the UK’s largest technology companies, you need to be a little bit careful and check whether you’ll be compliant when the new regime

-

Got HMRC approved software for Making Tax Digital?

Making Tax Digital is on its way. Next year, if your turnover is over the VAT threshold, you’ll need to submit returns online. In readiness, HMRC has been working with more than 150 software suppliers who have said they’ll provide software for Making Tax Digital for VAT in time for April 2019. If you’ve got a system

-

HMRC Delays Making Tax Digital

HMRC has announced a number of changes to the Making Tax Digital scheme. They have revised the timescale following feedback from businesses, accountants and Parliament. This is good news because it means that businesses will now have more time to implement the changes required. Similarly, many smaller businesses or self-employed individuals will not have to