The real impact of targeting salary sacrifice

We recently shared this article as a guest post for the Cornwall Chamber of Commerce, written by our MD, Laura Whyte, in her role as Chair of the Chamber.

In it, Laura explores the real-life implications of the frozen £100,000 tax threshold, how crossing it can reduce childcare support, trigger higher tax rates, and cut into household disposable income. She also highlights why salary sacrifice has become an essential tool for many professionals trying to navigate these pressures.

Laura Whyte, Chair of Cornwall Chamber of Commerce and MD of Whyfield

People are rejecting pay rises, working less hours and making huge pension contributions to avoid the £100,000 tax nightmare.

An employee who breaches this income threshold begins to face a massive financial disadvantage by losing childcare benefits and paying a higher income tax rate equivalent to 60% above this key figure.

Childcare

In the UK, families are entitled to up to 30 hours of free childcare per week for children aged 9 months to school age. However, this entitlement is means-tested and if either parent earns over £100,000 in adjusted net income, the family loses eligibility for these valuable childcare hours.

‘Adjusted net income’ means your salary after any salary sacrifice arrangements i.e. pensions (and other similar adjustments)

In addition to the 30 hours, eligible families are also entitled to up to £2,000 each year per child under 11 towards childcare costs through the Tax-Free Childcare scheme. For every 80p parents pay in, the government tops it up by 20p. This can be used to subsidise hours above the weekly allowance of 30.

However, once either parent breaches the £100,000 threshold, the only childcare benefits available to their family will be 15 hours free care for three and four-year-olds.

In financial terms, this means a parent with two children would need to earn £127,000 before they had as much disposable income as when they earned £99,000.

It’s worth highlighting that the £100,000 threshold hasn’t changed since 2017, and in that 9-year period, a £100,000 annual salary would now need to be around £134,000 to have the same purchasing power in line with inflation.

Taxation

A further impact of the £100,000 salary milestone is losing the Personal Allowance – the amount you can earn each tax year before Income Tax is due. This could mean you fall into and effective rate of income tax at 60%.

For every £2 you earn above £100,000, you lose £1 of the Personal Allowance, which is £12,570 in 2025/26. So, once you’re earning £125,140 or more, you don’t have any Personal Allowance. The real term impact is losing 20% relief and paying 40% in its place. As a result, you’re effectively paying 60% tax on this portion of your income.

Child Benefit

Child benefit is lost when one parent earns over £60,000 and they must pay back 1% of the benefit they have received for every £200 earned over £60,000. Furthermore at £80,000 – the amount to pay back hits 100% of the benefit meaning its lost all together.

Salary Sacrifice

This is a popular way that people invest into their pensions and help alleviate some of the tax threshold impacts experienced as earnings increase.

This has always been perceived as a positive as it reduces the tax and NI for the employee, reduces the Employers NI costs and encourages higher pension contributions which aim to reduce reliance on state pension funds and local authority support as our workforce reaches retirement.

Of course, in addition to tax savings, using salary sacrifice to reduce income enables wider access to childcare support for working families in those early school years.

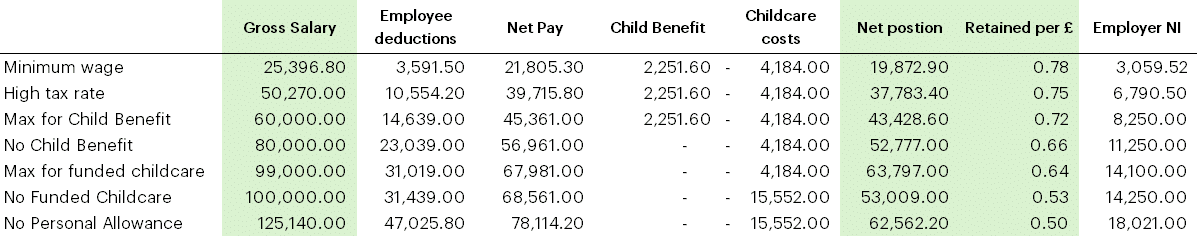

The figures

Below is a table to show the impact of hitting these earnings thresholds on childcare and tax. This illustration is based on one parent’s earnings over a 40-hour week in a family with 2 children. (No pension costs included)

The income scenario looks different for each household and acknowledging that income over £100,000 may seem more than most people’s earning capabilities, but the removal of salary sacrifice will affect earners across the entire scope of income levels through tax thresholds and benefit caps.

In 2017, earning £75,000 a year would have been the equivalent of £100,000 today.

Whilst salary sacrifice restrictions are more likely to affect people earning in excess of £50,000, the impact on this group of individuals is likely to be significant. Statistics show they are usually in management roles, more likely to have student loans (not considered in the calculations) and with the removal of Level 7 funding for employers to upskill leadership level employees, the impact in organisational stewardship could be compromised through reduction of hours by key individuals such as medical practitioners, lawyers, software engineers & developers, C-Suite officers, and engineering technicians.

Whilst the calculations we have provided are broad and don’t represent the varying circumstances, they do illustrate the ongoing pressure of our current economic climate and how the budget announcements can ripple through an entire workforce.

Interestingly, there has been growing awareness around this group of earners who have been coined “Henrys”: ‘High Earners Not Rich Yet’, which encompasses the challenges they face.

We will update budget announcements as they happen, and this blog is intended to share the context and an opinion on the impact of potential changes on 26th November.

If you have any questions about the above, we’re here to help.

You can call us on 01872 267 267, email us contact@whyfield.co.uk, or message us via WhatsApp (0777 49 39 111) or our socials.

For regular updates and information, make sure you’re following our socials: