Coronavirus Loan Schemes: Final Lending Figures in the South-West

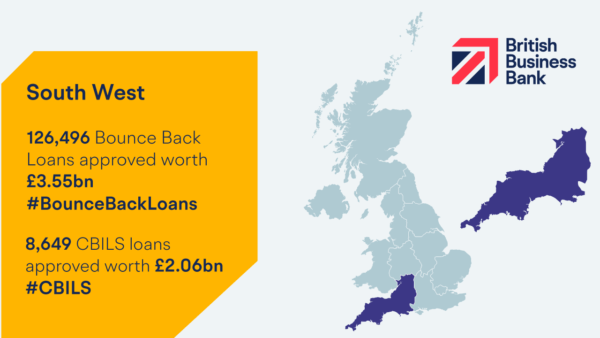

New data from Coronavirus loan schemes have been released today (6 July 2021). In the South-West alone, businesses received over £5.6bn from the Coronavirus Business Interruption Loan Scheme (CBILS) and the Bounce Back Loan Scheme (BBLS).

These schemes closed in March 2021 after providing much needed support to businesses impacted by the pandemic.

Coronavirus Loan Schemes Breakdown

Coronavirus Business Interruption Loan Scheme

Nearly 126,500 loans worth nearly £3.6bn have been provided across the region under the Bounce Bank Loan Scheme, which provided a six-year term loan from £2,000 up to 25% of a business’ turnover, with a limit of £50,000.

Bounce Back Loan Scheme

Over 8,600 loans worth over £2bn have been provided across the region under the Coronavirus Business Interruption Loan Scheme, which provided Business loans, overdrafts, invoice finance & asset finance of up to £5m to businesses with a turnover less than £45m.

What impact has the schemes had on businesses?

Steve Conibear, UK Network Director, South and East of England at the British Business Bank said:

“The COVID-19 loan schemes have been an important part of the government’s response to the pandemic, providing businesses with much-needed breathing space and reducing cashflow concerns for many. We’re pleased to see evidence that they have helped smaller businesses right across the South West and look forward to helping more businesses to prosper and grow as we look towards economic recovery.”

Wadebridge case study

As with all hotels across the country, the emergence of COVID-19 meant Hustyns Hotel & Spa, a country resort, had to shut down for a number of months to comply with government guidelines. Ceasing trading affected the business’ revenue significantly, which is why it applied for a CBILS loan for support.

Ravi Gupta, Managing Director of Hustyns Hotel & Spa said:

“COVID-19 has posed unique challenges to the hospitality industry – it’s been a real year of volatility. The CBILS loan means that we can not only weather the latest lockdown but make investments in our resort and know that our business’s future is secure for the next two years.”

More data and a breakdown of loans offered by region are available in the British Business Bank press release.

Our COVID-19 centre has been kept up to date with the latest funding schemes and support. Check back there regularly or if you have any burning questions about coronavirus support schemes and other support for your business speak to our team, they’re always happy to advise.